Blogs

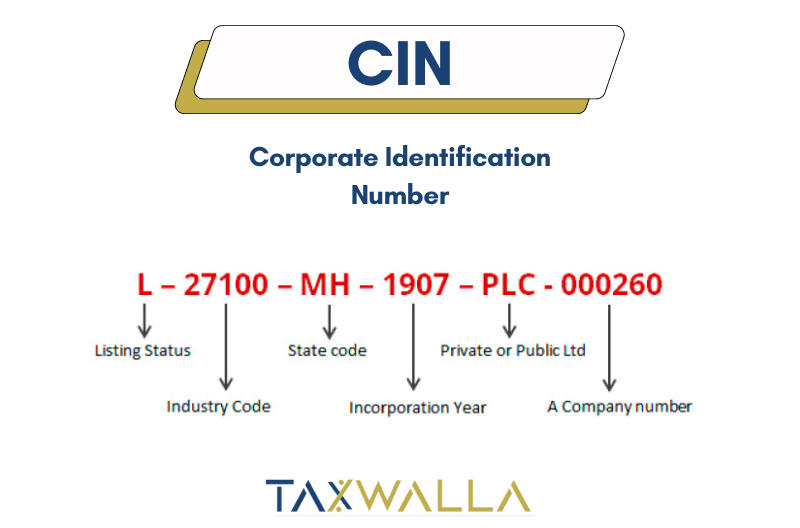

CIN Number – Know its Meaning, Usage & How to Obtain CIN

CIN stands for Corporate Identity Number. It is a unique alphanumeric identification number assigned to Indian companies by the Registrar of Companies (RoC) under the Ministry of Corporate Affairs. CIN is used to identify and track the various companies registered in India. Here's some information about CIN:

Read More

Understanding Shareholding and Capital Structure in Company Registration

When registering a company, one crucial aspect to consider is the shareholding and capital structure. These elements determine how ownership is divided and how capital is allocated within the company. Understanding shareholding and capital structure is essential for founders, investors, and stakeholders, as it establishes the rights, responsibilities, and financial aspects of the company. Here are some key points to grasp:

Read More.png)

Benefits of Registering Your Company as a Limited Liability Company (LLC)

Discover the benefits of registering your company as a Limited Liability Company (LLC). Enjoy limited personal liability, flexible management structure, pass-through taxation, and more.

Read More

Navigating Taxation: Insights and Tips for Financial Wellness

where we aim to demystify the complexities of taxation and provide you with valuable insights and tips for achieving financial wellness. Whether you're an individual taxpayer, a small business owner, or simply interested in understanding the ins and outs of the tax system, this blog will serve as your go-to resource for all things tax-related. Our team of experts will cover a wide range of topics, including tax planning, deductions, credits, changes in tax laws, and much more. Let's dive in!

Read More.png)

How to Choose the Right Company Name and Register It

Choosing the right company name is an important part of the branding process and can greatly impact the success of your business. Once you have chosen the perfect name, you will need to register it to make it official and protect your brand. Here are some tips on how to choose the right company name and register it:

Read More

How to Navigate Employment Law: Tips for Hiring and Managing Employees

Navigating employment law is crucial for managing a successful business. This blog provides tips for hiring and managing employees while staying compliant with employment laws.

Read More

How to Reduce your Company’s Tax Burden

Most entrepreneurs are experts in their business field but need to understand more about the tax impact. This happens for several reasons. First, the laws are changed all the time. In addition, business people are only sometimes clearly informed.

Read More

Everything you wanted to know about Sweat Equity shares and ESOPs

Sweat equity shares are issued by the company to its employees on favorable terms in recognition of their work. Many of us believe that both sweat equity shares and Employee Stock Options (ESOPs)are the same but they are two different aspects.

Read More

RBI allows KYC on video for customer on-boarding. Fintechs welcome it with open arms.

Read More

Benefits Under Startup India

Being incorporated or registered in India up to 10 years from its date of incorporation.

Read More

Comparison Between LLP and Pvt Ltd

Below are the various points that show the difference between LLP & Private Limited Companies

Read More

Comparison Between LLP and Partnership Firm

Below are the various points that show the difference between LLP & Partnership Firm

Read More

Advantages of One Person Company

“One Person Company” means a company which has only one person as member.

Read More

Advantages of LLP

A Limited Liability Partnership, popularly known as LLP is an alternative corporate business form that gives the benefits of limited liability of a company

Read More

Advantages of Private Limited Company

A Private limited company is a type of a privately held small business entity. A Private Ltd business entity limits the owner's liability to their shares.

Read More